Market Melt-Up 01.21.2025

Chief Investment Officer

The question on everyone’s mind as we enter the new year is whether the markets will keep rolling higher.

After a disastrous 2022, when rates and inflation simultaneously soared, traditional balanced portfolios (which many prognosticators proclaimed was a dying investment allocation methodology) have now had multi-year double-digit returns. Once again, similar questions regarding the consumer and high valuations on equities are creeping into economic outlook predictions. When will the consumer capitulate to less stimulus and higher inflation, and how long can markets trade at all-time highs?

At the onset of last year, we recommended:

-

Taking profits in high valuation areas of the stock market

-

Considering investments in bonds at multi-year high yields (where appropriate)

-

Looking for opportunities in the equity markets with more reasonable valuations

-

Not being ashamed to hold a little extra cash in the portfolio, given higher yields

We also recommended not throwing in the towel on stocks and holding steady on long-term strategic positions. Apart from holding extra cash (yields have started falling with the Fed pivot and likely will continue to decline over the coming year), our other 2024 recommendations continue to make sense given similar economic fundamentals. Of course, as my market scars over the last two decades testify, trying to predict the direction in which markets and interest rates will go is certainly a difficult task. Bearing this in mind, below is a snapshot of some key economic drivers and how they are influencing where we place client assets.

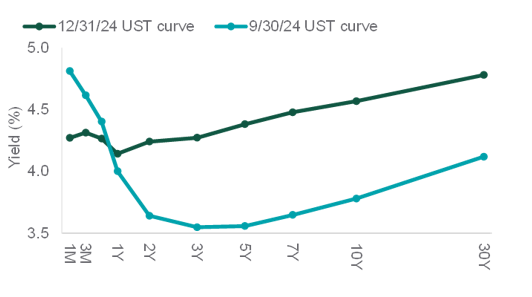

After an initial wave of post-election market euphoria, the markets have settled into a more skeptical “show-me” stance. Bond markets have become stubbornly independent of the Federal Reserve’s downward course, with long-term rates moving significantly higher in the final quarter of the year. These higher bond yields will almost certainly shape the next leg of the market journey. Below is a graphical representation of the yield curve, highlighting short-term rates (dictated by the Federal Reserve) going down, and long-term rates (controlled by the bond market) going up. Left to right, the chart starts with one-month yields and progresses to 30 years on the far right.

Source: Northern Trust Investment Institute

Higher rates on the longer end of the curve will almost certainly slow the housing market while creating additional headwinds for commercial real estate and other rate-sensitive parts of the market. If the 10-year treasury yield remains above 4.5%, this certainly introduces pressure for stock multiples causing headwinds if companies cannot produce forecasted earnings.

Switching gears from rates, the American consumer continues to power our economy, outpacing all expectations of financial prognosticators the past two years. The Fed has seemingly walked a tightrope, producing what looks like an economic soft landing after consistently lower inflation data from peak levels in 2023. Given a strong labor backdrop and decelerating inflation, our view is that the consumer remains healthy, but the pace of their spending naturally slows. Our base case of a continued soft landing is likely, while a more strained setup could depend on which part of Trump’s agenda wins out, i.e. the benefits of fewer regulations and lower taxes versus higher tariffs and tighter immigration controls. Some think that all four policy pillars will have positive effects.

Although US stocks as a group are trading well above average price valuations, there are pockets of value in sectors that have not participated in the AI (Artificial Intelligence) and Technology booms. For example, many Health Care, Financial and Industrial names look particularly attractive. As a firm, in addition to looking for value in the market, we have added to Small Cap positions in anticipation of lower rates, their focused domestic revenue profile, and comparatively lower valuations.

For many clients, although less spicy than their high-octane equity brethren, it has been practical to pick up bonds paying coupons between 4-6%. In many instances we have been able to lock in cash flows that often meet or surpass spending (and/or financial planning) needs. This is a most welcome change given the last two decades of zero-bound rates, which punished savers looking for reasonable returns at a lower risk level. Although reducing risk during a roaring stock market can sometimes feel counter-intuitive, we believe it is not only prudent but increases probabilities of long-term, consistent investment success.

As always, we appreciate your support and trust in WealthSouth. We look forward to meeting with you in the new year, reviewing your investments, discussing ideas and hopefully giving you peace of financial mind.