18 Jan Bears, Inflation & The Fed 01.10.23

Looking Into the New Year

At the time I wrote my last state of the union on the economy in early 2022, our team forecasted the market was “due” a correction. We were experiencing higher than normal equity valuations, strong underlying economic fundamentals and strong double-digit year-over-year returns. Of course, we were uncertain of the events that would tip the scales or the magnitude of the bear market that followed.

As we now know, the trigger for the selloff in both stock and bond markets was primarily two-fold: 1) the conflict in Ukraine, which exacerbated inflation, and 2) the subsequent rise in interest rates the Fed brought on in trying to catch up with ever-higher inflation reports. As the cost of money shot up in a historically short period of time, investors, consumers, and businesses were forced to re-evaluate the value of literally everything from stocks and bonds to houses and crypto.

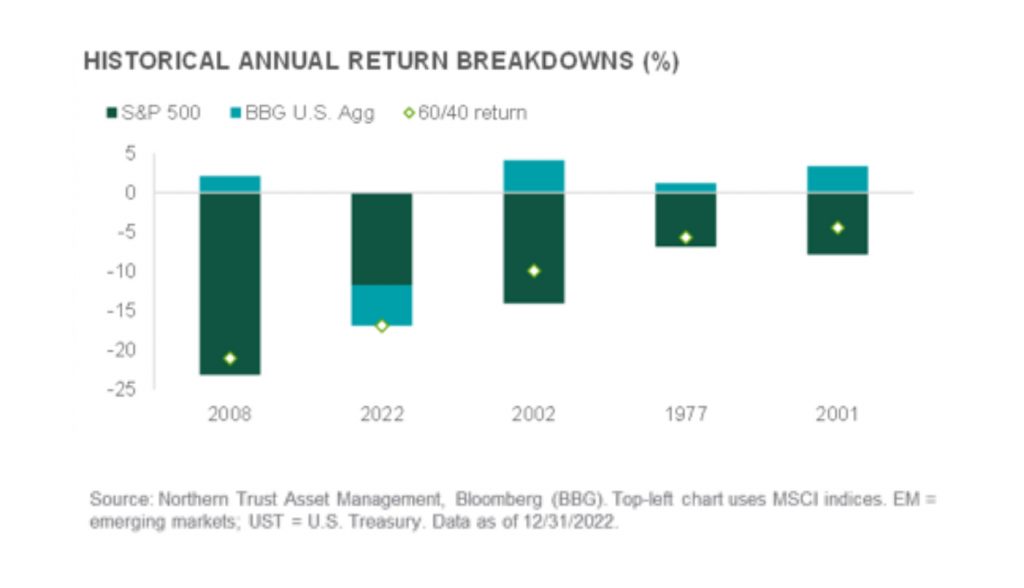

This caused a great deal of volatility in almost every asset class we follow. For traditional balanced investors, this has been a particularly difficult year in that both stocks and bonds sold off simultaneously. As the chart below highlights, this is the worst year for 60/40 (stock/bond) portfolios since 2008 and the most volatile for bonds since 2009.

If you have met with members of our investment team lately, you have probably heard us describe how (although we never know the timing of them) we expect market corrections, recessions, and bear markets over most normal market cycles. In fact, we build our portfolios to anticipate them and stress our financial plans to weather them. I say this not to lessen the impact of seeing portfolios decline in value this year but rather to recognize the inevitability of stresses we are likely to see through the course of our investing lives.

Fortunately, our focus on high quality companies that trade at reasonable valuations held up well on a relative basis versus the rest of the market. This strategy helped us avoid over-priced ‘COVID-Tech’ companies, meme stocks with lackluster balance sheets, and crypto-related companies with no cash flows. Other strategies that helped us protect portfolios on the downside include dedicated positions in natural resources and TIPS (Treasury Inflation Protected Securities), while keeping our fixed income portfolios shorter than average in duration.

Senior Vice President

Chief Investment Officer

As market participants continue to readjust to this new interest rate environment, we recognize there are some difficult hurdles for the markets as we plot our course in 2023. Inflation, although we believe it continues to recede, will most certainly remain above the magical 2% Federal Reserve target. This will pressure the central bank to remain somewhat hawkish for at least the first half of 2023, perhaps moderating its stance later in the year as the data becomes less onerous. The focus will now shift to earnings and whether companies can weather the manufactured Fed economic slowdown designed to combat inflation, as the runway for the much lauded economic “soft-landing” continues to narrow. Geopolitics will continue to be the wildcard, with the ongoing conflict in Ukraine stressing energy markets and China-Taiwan tensions causing concern for the chip industry.

I never like to leave my letters on a negative note, so in that spirit let us reflect on the positives that came out of 2022. The rise in interest rates has revalued not only the stock market, but also the bond market. For the first time in 10-plus years, bond yields are providing an attractive alternative to stocks and those in retirement finally have more conservative options outside of money markets paying 0.01%! Further, the starting point for equity valuations appears more reasonable, trading in line or below long-term averages. From a fundamental standpoint, the banks have stellar balance sheets having fortified after the Great Financial Crisis in 2008, and overall company earnings have held up better than most expectations. Tailwinds for markets this year include a stabilization in interest rates and inflation, COVID continuing to wane, and clarity around the Federal Reserve’s terminal rate. Given some of these factors, we believe if we go into a recession, it will be short and shallow.

My final thought is a reminder stock markets are forward-looking mechanisms. Often, when confidence and economic statistics are most bleak, markets are already plotting their recovery reflecting 6-12 months into the future. Historically, it has been difficult to time when the move will happen and how quickly the reversal will take place. With this in mind, we advise clients to avoid making large changes to their current investment strategy and to remain patient during this difficult transition.

We look forward to meeting with you in person this year, reviewing your investments and how we are positioning them for the future. Wishing you all the best in the new year!