18 Jan We Didn’t Light It, We Tried To Fight It 01.11.24

We Didn’t Light It, We Tried To Fight It

Chief Investment Officer

As I reflect on 2023, I’m reminded of Billy Joel’s famous song, “We Didn’t Start the Fire”, in which he lists major historical events over a 40-year time frame. Many of the moments in time reference conflict and economic stress. This past year, we had plenty of fires with bank failures, continued fighting in Ukraine, decade-high mortgage rates, conflict in Gaza, and persistent inflation. We certainly did not start the inflation fire, rather those seeds had been sown by decades of loosening monetary policy, culminating with a pandemic-induced deluge of stimulus placed directly into consumers’ pockets.

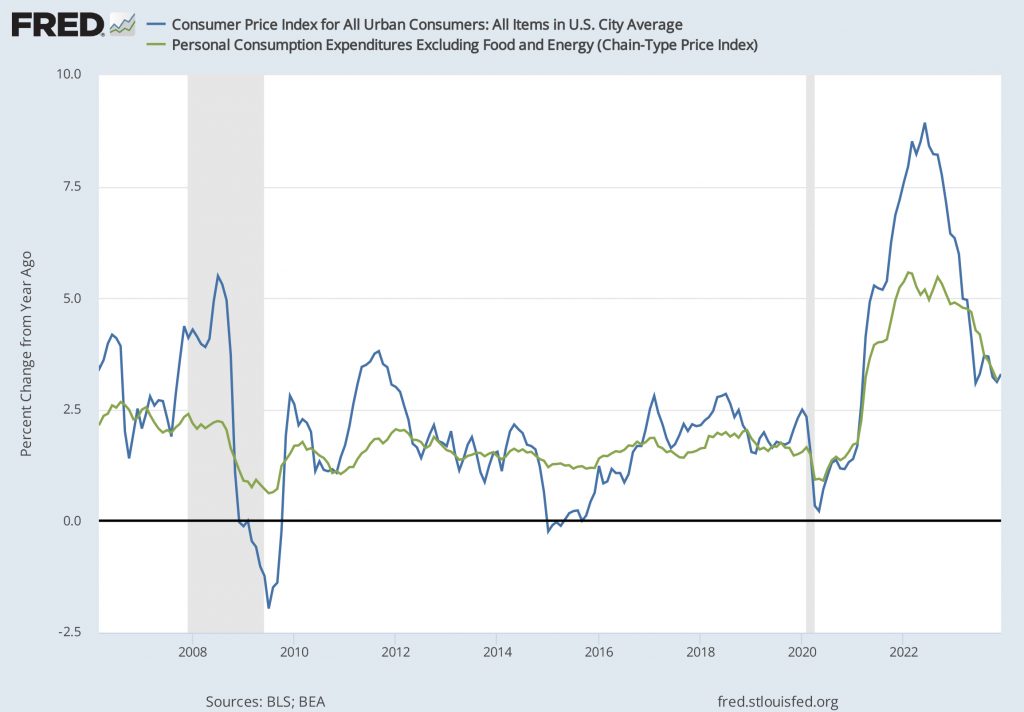

As in 2008, and more recently in 2020, there were plenty of reasons to abandon the markets in 2023. In fact, most economists predicted (with absolute certainty) a recession was in the cards. Between all the fires and negative predictions, many investors headed for safety and were somewhat rewarded until the last quarter of the year, when those who abandoned the markets missed out on significant returns. Cooling core CPI (a broad inflation gauge – shown below) was the trigger, and it combined with oversold equity and bond markets for one of the largest quarterly rallies for balanced portfolios in history.

The market now believes the Fed has manufactured a “soft landing” scenario and will be throwing water on the flames for the foreseeable future by decreasing the Federal Funds Rate. With a perceived dovish future Fed, stocks rallied and bond prices soared as rates dropped precipitously across the board.

After its worst year in decades, the 60/40 (stock/bond) portfolio rose from the dead and staged a historic comeback, averaging double-digit returns and recapturing much of the 2022 losses. Given the underlying economic fundamentals and difficulty in timing interest rates, as a firm we stayed fully invested throughout the year, with neutral tactical positions against our clients’ target weights.

One area where we shifted dramatically in the past 18 months is our interest, no pun intended, in bonds. From a risk/reward standpoint, a +4% starting yield is attractive given that the earnings yield on stocks is not much higher in the current economic environment. We maintain that now is the time to lock in rates before the Fed moves lower. Our largest challenge this year was similar to 2021 when companies with high valuations (P/Es), no dividends and a growth profile outperformed value-orientated companies to the tune of 31%. Conversely, as an investment group that focuses on purchasing high quality securities with strong dividend growth, consistent earnings, and reasonable valuations, this was certainly a headwind in terms of relative benchmark performance. It was compounded by the fact that the top 10 stocks in the S&P 500, by weight, registered 86% of the share in return, while only making up 23% of the earnings. Despite the challenges, our discipline has consistently been either in-line or better than benchmarks over the past two-, three- and five-year time periods.

WealthSouth is in the camp that the Fed has likely avoided a full-blown recession, but there are hurdles of which to be cognizant:

- Rates are still materially higher than they have been at any point in the last two decades.

- nflation (although lower year-over-year) has damaged consumer purchasing power in many areas of our economy.

- Mortgage rates remain high.

- Commercial real estate still has the office space hangover from COVID, which appears structural for years to come.

GDP (Gross Domestic Product) growth and employment will need to remain strong to offset these persistent forces.

Looking ahead in 2024, we remain wary of the impacts that smoldering inflation and interest rates may have on future-looking returns. Geopolitical concerns are now bubbling to the surface as well, with free movement of goods through the Red Sea, which carries 12% of global trade, hampered by Houthi rebels. Further, an amazing 7.9 billion people will be impacted by elections in 2024, many highly consequential like our own presidential election and the politically sensitive Taiwanese election. For those of our clients who follow trends, in a U.S. presidential election year, average market returns have annualized at 6.1% and GDP growth has been 3.8% per year, both lower than the year preceding an election. Statistically, real GDP averages higher under Democrats, while the stock market trends average higher under Republican leadership. Pick your poison!

Despite the heady geopolitical landscape, we are cheered by a reasonable set up for stock and bond markets going into 2024. We believe the world will indeed keep turning despite the elections and fires. Some of the tailwinds include:

- Interest rates and inflation trending downward.

- Bond valuations and starting yields are attractive relative to decade-long levels.

- Strength in the U.S job market.

- Consumer spending remains healthy.

Given the balance of information in the marketplace, we are not looking to make major changes to client portfolios at this time. Rather, we are focused on the fundamentals of rebalancing portfolios to lock in recent gains and take advantage of valuations (primarily bonds and some parts of the equity market), where appropriate. We are also not adverse to holding a little extra cash given the higher yields and strong Christmas rally in most asset classes.

Thank you for your continued support and trust in WealthSouth. We look forward to reviewing your investments, discussing ideas, and developing plans to help you and your family in your financial decision-making.